Why Google’s US financial services play was way too hot to handle

This month Google axed its plans to launch a Googleplex bank account, reportedly following pressure from the large US Banks. Why was Google seen as a threat to the established institutions, and what can we learn from the ashes of Google’s plan? It may well be that Google’s financial services value prop for Gen Z was just too threatening.

The story starts 60km north of Seattle

On the face of it, the sleepy commuter town of Everett in Washington State isn’t the obvious ground zero for the future of digital financial services. It’s the home base for Coastal Community Bank, a seemingly unremarkable regional institution with just 13 branches. But despite its modest size, this little community bank was up until this month working with Google to change the face of financial services, notably with Google’s planned GooglePlex bank account. Google has repeatedly said it will never become a bank, but it had chosen a small number of banks to JV with. Google Plex was going to be a big evolution on the Google Pay platform, one that included a partner transaction account, savings account, P2P payments, ecommerce and loyalty programs all smashed into one app. I believe Google above any other tech company, including Apple and new fintechs, was the business most likely to attract Gen Z for their banking needs. Established banks were watching this plan closely – as, in many ways, it was a proxy for understanding what Generation Z want from their bank.

What do Gen Z need from a bank?

Future profits and growth for financial services lie in Gen Z, the early to mid-twenties age cohort who are soon to be the mainstream consumers of pretty much everything. This audience has a distinct set of hot buttons best summed up in the CTP equation:

Convenience + Trust + Personalisation = Value

Google has a distinct advantage with all three of these defining factors.

Convenience

Recent research looking at potential features on a Googleplex transaction account from Cornerstone Advisors underlines how critical convenience is to this generation. In particular, the combination of location-based data signals with payment platforms is highly attractive, allowing for features like ‘Get Gas’, which will find the nearest petrol station and also pay for your fill in one simple experience.

Trust

You can’t not notice. Google is currently blitzing us with advertising that it hopes demonstrates why it should be trusted as the protectors of our data. It wants to be seen as the data police, and ultimately the good guy. In the ‘do I trust them?’ stakes Google already has a good foothold on trust, ranking as the number one most trusted brand in Australia – even beating Bunnings. The same survey from The Brand Institute of Australia has no bank on the top 40 most trusted brands (ING comes in at 44th place)

If we’re being honest, Google’s data protection promises aren’t a sign of altruism, but a key pillar to owning the high ground Trust takes.

Personalisation

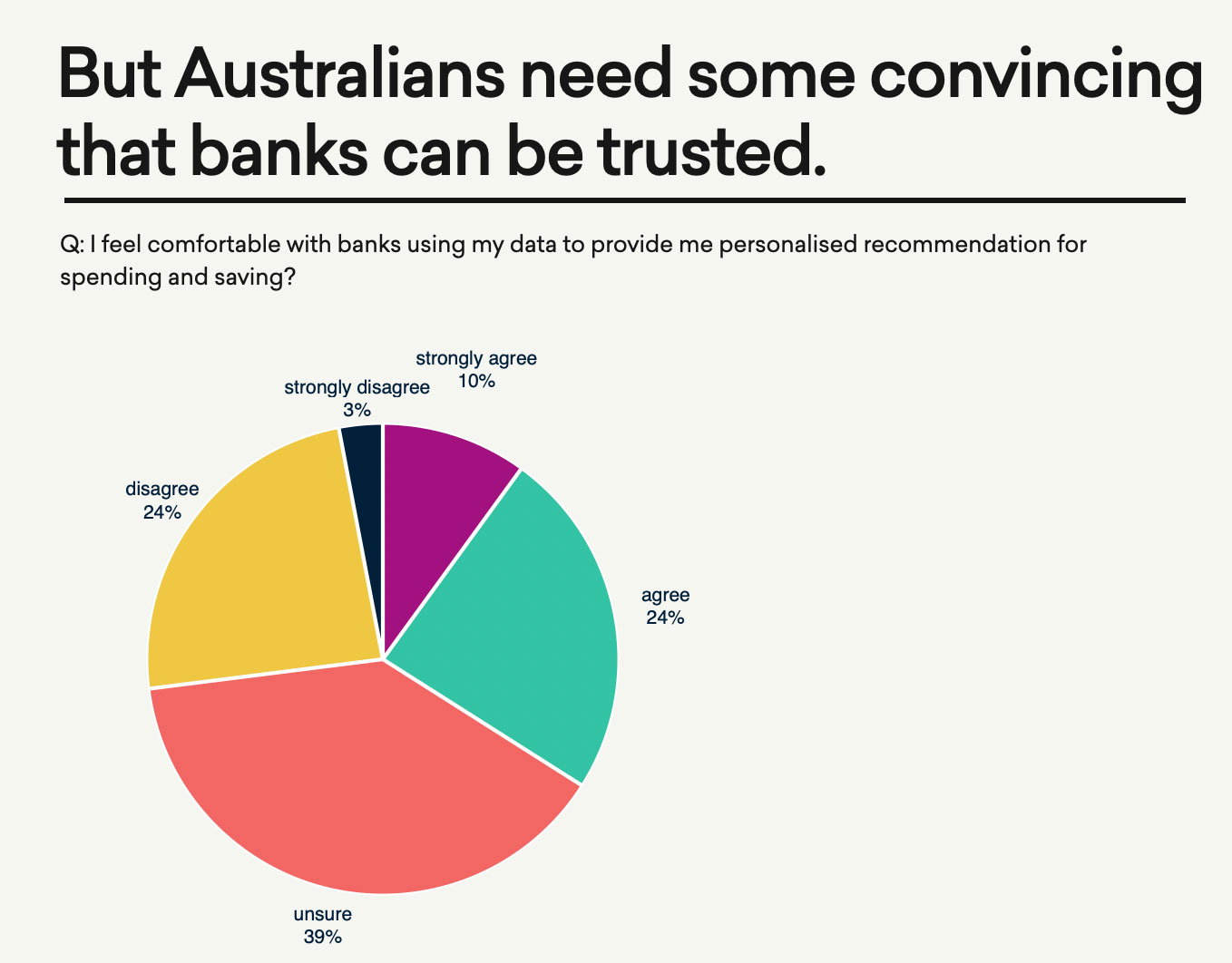

The problem many Australian banks face is that consumers don’t trust them with their data. Our recent ‘Are You Ready?’ research (July 2021) clearly identifies the problem, with only 34% of consumers trusting their bank with their personal data to drive personalised experiences:

To deliver personalised experiences, you need rivers of data – and Google has them in Amazonian proportions. If you go to your Google account under ‘Privacy and Personalization’ and then tap ‘Ad Personalization’, you can see what Google knows about you. In my case there are 178 different targeting attributes that are scarily accurate (except, perhaps, for my supposed fascination with power tools).

The possibilities for creating fin services value for Gen Z are extraordinary, and no one brand has yet owned this cohort. But it’s clear that the winners in this game will be the businesses that deeply understand the 4.6 million Gen Z consumers who will shape the future of every product and service we sell. With Google apparently retreating from this ambition it will be fascinating to see who fills the void and actually delivers tangible value for Gen Z and their money.

References/Sources

- https://www.savings.com.au/credit-cards/cba-says-apple-pay-google-pay-to-become-the-most-popular-way-to-pay

- https://www.statista.com/forecasts/1187984/online-payments-by-brand-in-australia

- https://thefinancialbrand.com/116739/community-bank-builds-future-on-banking-as-a-service-google-plex/

- https://www.9news.com.au/national/bunnings-and-google-named-as-brands-most-trusted-by-aussies/81e21986-2d46-4aeb-a4fc-eeaec0da3780

- https://thefinancialbrand.com/112405/google-plex-checking-savings-fintech-big-tech-partnership-ron-shevlin/

- https://www.statista.com/forecasts/1187984/online-payments-by-brand-in-australia

.png)

.jpg)